We’ve received many questions recently related to HSA and FSA accounts. While both healthcare accounts can be useful investment and savings tools, understanding the difference between the two accounts is oftentimes challenging.

Check out our crash course in healthcare savings accounts below, and check out our favorite products on Amazon that are FSA eligible. Don’t hesitate to comment with any questions below or on our Instagram!

Want more information like this? Make sure to sign up for our mailing list.

This article was originally published March 2019 and was last updated February 2023.

What do HSA and FSA stand for?

HSA: Health Savings Account

FSA: (Health) Flexible Spending Account

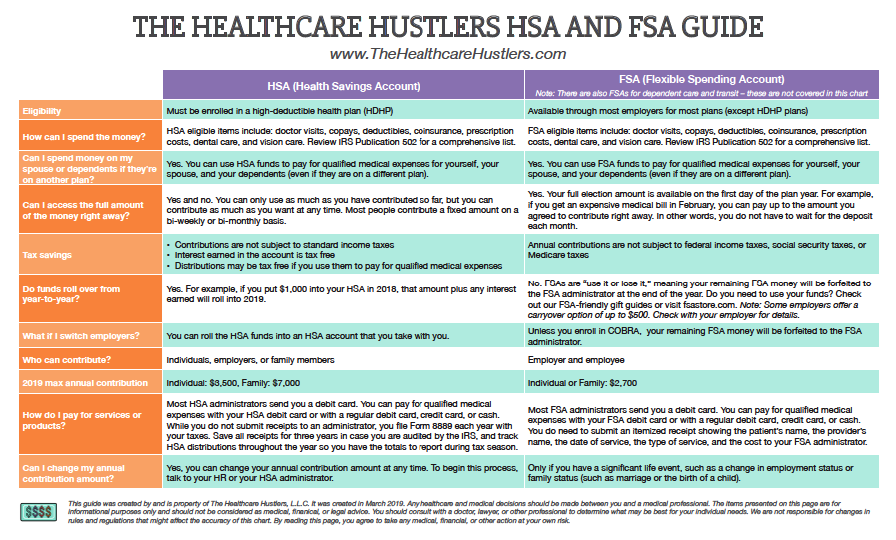

Note: There are also FSAs for dependent care and transit – these are not covered in this article.

What is the eligibility for FSA and HSA plans?

HSA: Must be enrolled in a high-deductible health plan (HDHP)

FSA: Available through most employers for most plans (except HDHP plans)

How can I spend HSA and FSA money?

HSA: HSA Eligible Items

Includes: Doctor visits, copays, deductibles, co-insurance, prescription costs, dental care, vision careFSA: FSA Eligible Items

Includes: Doctor visits, copays, deductibles, co-insurance, prescription costs, dental care, vision care

Can I spend HSA/FSA money on my spouse or dependents (Even if they are on a different plan)?

HSA and FSA: Generally speaking, yes. You can use HSA funds to pay for qualified medical expenses for yourself, your spouse, and your dependents (even if they are on a different plan). If your spouse has an HSA and you have an FSA (or vice versa), things become more complicated and you’ll want to talk to your HR).

Can I access the full amount of HSA/FSA money right away?

HSA: Yes and no - it depends how you contribute. Most people contribute bi-weekly via direct deposit from their pay, but you can contribute a lump sum at any time. Let’s look at these examples carefully:

You contribute a fixed amount from your paycheck every few weeks: You can only use as much as you have contributed so far. If you planned to contribute $1,000 for the year and you get an expensive medical bill in February, you will only have had 2-3 pay periods, so you will only be able to access around $120 (plus any remaining amount from the previous years).

Tip: If you contribute bi-weekly but have a large bill, ask the hospital billing office to put you on a monthly payment plan. By spreading out the amount due, you will be able to take advantage of your HSA bi-weekly contribution. Read more here.

You contribute $1,000 in January: You can still only use what you have contributed so far, but because you contributed up front instead of spreading it out, you will have access to the full $1,000 in January. If you do contribute a lump sum, talk to your HSA provider and your employer to ensure you submit it properly - you’ll need documentation for taxes.

FSA: Yes. Your full election amount is available on the first day of the plan year. For example, if you get an expensive medical bill in February, you can pay up to the amount you agreed to contribute right away. In other words, you do not have to wait for the deposit each month.

HSA/FSA Tax Savings

HSA:

Contributions are not subject to standard income taxes

Interest earned in the account is tax free

Distributions may be tax free if you use them to pay for qualified medical expenses

FSA:

Annual contributions are not subject to federal income taxes, social security taxes, or Medicare taxes

Do HSA/FSA funds roll over from year-to-year?

HSA: Yes. For example, if you put $1,000 into your HSA in 2021 and don’t spend it, that amount plus any interest earned will roll into 2022.

FSA: No. FSAs are “use it or lose it,” meaning any unused funds at the end of the year are forfeited. Do you need to use your funds? Check out the FSA friendly gift guides here and here.

Note: Some employers offer a carryover option of up to $500. Check with your employer for details specific to your plan.

What happens to my HSA/FSA accounts if I switch employers?

HSA: You can roll the HSA funds into an HSA account that you take with you.

FSA: Unless you enroll in COBRA, your remaining FSA money will go back to your FSA administrator. Spend it before you leave!

Who can contribute to my HSA/FSA account?

HSA: Employee (self), employers, or family members

FSA: Employee (self) or employers

What is the Maximum HSA/FSA annual contribution for 2022?

HSA: Individual: $3,650, Family: $7,300

FSA: Individual or Family: $2,750

How do I pay for services or products with my HSA/FSA account?

HSA: Most HSA administrators send you a debit card. You can pay for qualified medical expenses with your HSA debit card or with a regular debit card, credit card, or cash. While you do not submit receipts to an administrator, you file Form 8889 each year with your taxes. Save all receipts for three years in case you are audited by the IRS, and track HSA distributions throughout the year so you have the totals to report during tax season.

FSA: Most FSA administrators send you a debit card. You can pay for qualified medical expenses with your FSA debit card or with a regular debit card, credit card, or cash. You do need to submit an itemized receipt showing the patient’s name, the provider’s name, the date of service, the type of service, and the cost to your FSA administrator.

Can I change my annual contribution amount?

HSA: Yes, you can change your annual contribution amount at any time. To begin this process, talk to your HR representative or your HSA administrator.

FSA: Only if you have a significant life event, such as a change in employment status or family status (such as marriage or the birth of a child).

Other items to be aware for your HSA account:

HSA: HSAs are favorites of the Financial Independence Retire Early (FIRE) crowd, as they are a tax free investment account.

If you are enrolled in a HDHP with an HSA, you should have a basic understanding of how you can “shop around” for healthcare, as prices vary. We recommend that you read these articles:

If you have an HSA, then switch to a non-HDHP plan, you can keep your HSA money but you should stop contributing new funds to the HSA account.

You can deposit your HSA money with any HSA provider you choose. As with any investment account, you’ll want to compare fees and investment options that different HSA companies offer.